Invinitive Financial UK Ltd is a specialist UK platform provider focused on giving clients simple, transparent access to tax-efficient investing – wherever life takes them. We operate and administer the Invinitive SIPP, the Invinitive General Investment Account and the Invinitive Stocks and Shares ISA (including children’s versions of each), combining robust UK regulation with modern, digital technology that works for both UK residents and expatriates.

Our role is to provide a safe, well-governed home for your pension and investment assets, with clear charges, flexible investment choice and efficient administration. We do not provide financial advice; instead, we give you and your regulated adviser the tools and infrastructure to put your investment strategy into practice.

Who we are

We are an independently owned, FCA-authorised firm based in the UK, built specifically to serve clients with UK pension and investment assets – whether they live in the UK or overseas. Our team has extensive experience in the SIPP, platform and international pensions space, and we have seen first-hand how complex, opaque and expensive some solutions can become.

Invinitive was created to be different: a boutique provider with the scale, technology and governance of a mainstream platform, but with the responsiveness and common sense of a smaller firm. We want clients and advisers to know exactly where their money is, what it costs and how it is being looked after.

and our philosophy

Invinitive exists to provide a safe, efficient and fair environment for clients’ long-term savings and investments. That philosophy touches everything we do: the advisers we work with, the investments we permit, the technology we build and the policies we implement.

We want clients to feel that Invinitive is a “safe harbour” – a place where their pension and investment assets are administered carefully, costs are controlled and governance is taken seriously. We are not trying to be all things to all people. Instead, we focus on doing a smaller number of things very well: UK pensions and investment accounts, for UK residents and for expatriates with genuine UK connections.

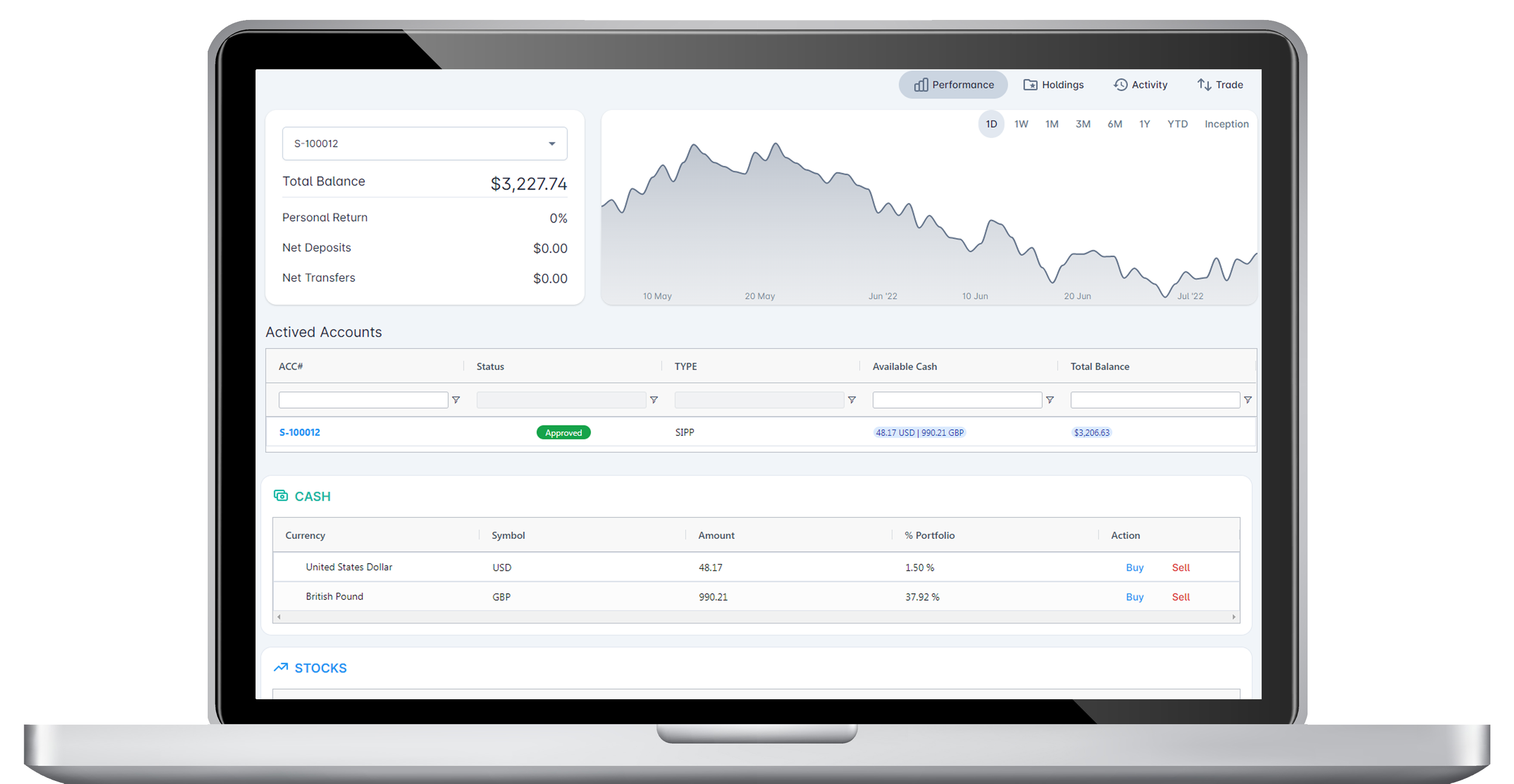

The Invinitive Platform

What we offer

-

Personal Pension

The Invinitive SIPP is a UK-registered Self-Invested Personal Pension that allows you to consolidate and manage your UK pension assets in one place. It is designed to be flexible and investment-friendly, with access to a wide range of mainstream investments and the ability to hold multiple currencies where appropriate.

-

General Investment Account

The Invinitive Investment Account (GIA) is a straightforward, flexible investment account. It is ideal for clients who have already used their ISA allowances, for those who wish to invest without pension or ISA wrappers, or for expats who want a simple way to hold investments in their own name.

-

Stocks and Shares ISA

The Invinitive Stocks and Shares ISA provides a tax-efficient way for UK residents and Non residents (with legacy products) to invest for the medium to long term. We also offer children’s versions of the SIPP, Investment Account and ISA, to help families plan for the future and build wealth across generations.

Who we work with?

We support both UK residents and international clients who have a connection to the UK through pensions or investments.

For UK residents, we provide a modern, low-friction alternative to traditional platforms: transparent fees, online access, straightforward onboarding and a broad investment universe, combined with UK regulatory protection.

For expatriates and international clients, we understand the additional complexity of living, working and retiring across borders. Our focus is on making it easier to keep UK pension and investment assets in a well-run, UK-regulated environment, rather than pushing clients towards unnecessary offshore structures. We work closely with regulated advisers who specialise in expatriate planning, while remembering that the underlying products remain UK retail products with UK standards of governance.

Getting the right advice

Although some clients come to us directly, many work with professional financial advisers. Our job is to support advisers by providing a platform that is intuitive, transparent and highly configurable, without ever crossing the line into giving advice ourselves.

We give advisers the ability to implement investment strategies efficiently, to monitor and report on client portfolios, and to access the information they need to discharge their regulatory duties. We recognise that, particularly in the international space, our permissions and our regulatory licence ultimately carry the risk; we therefore treat all non-UK advisory firms as non-regulated introducers for UK regulatory purposes, and apply appropriate oversight and controls.

Ready to get started?

Whether you are a UK resident looking for a straightforward, tax-efficient way to invest, or an expatriate wanting to bring order to your UK pension and investment assets, Invinitive Financial UK Ltd is here to help provide the structure.

If you already have a financial adviser, please speak to them about whether the Invinitive SIPP, Investment Account or ISA is suitable for you. If you are approaching us directly and are unsure what you need, we will be happy to explain how our products work and, where appropriate, suggest that you seek regulated financial advice before making any decisions.

Contact Us

Conventional

📞 Freephone in the UK:

0800 048 8485

📞 From Abroad:

+44 330 818 0845

📧 Email:

info@invinitive.co.uk

Live Chat

Please use the live chat button located at the bottom right hand corner of this webpage.This live chat is answered by real people and not Bots or AI driven responses.Our friendly and helpful team are on call throughout the day to assist you where needed.